Help investors understand their investment goals and choose properties accordingly

1) Introduction

Are you dreaming of financial freedom through property investment? The path to real estate riches is paved with careful planning and a clear understanding of your goals. Two key factors that can significantly impact your investment journey are capital growth and cash flow.

Capital growth refers to the increase in your property’s value over time. It’s like watching your investment appreciate, much like a fine wine. On the other hand, cash flow is the steady stream of income generated from your property, such as rental returns. It’s the reliable paycheck that helps you meet your financial obligations.

Understanding both capital growth and cash flow is essential for making informed investment decisions. You can build a robust portfolio that delivers long-term wealth and financial security by aligning your property investment with your financial objectives.

Beyond Realty is here to guide you every step of the way. With our deep understanding of the Australian property market, we can help you clarify your investment goals and select properties that perfectly match your vision. Let’s work together to turn your property dreams into reality.

2) Understanding Your Investment Goals

Before diving into the specifics of capital growth and cash flow, it’s crucial to define your investment objectives. This involves a deep understanding of your financial aspirations, risk tolerance, and lifestyle goals.

What are your financial objectives?

Your financial goals are the compass that guides your investment journey. Are you looking to achieve short-term financial targets like a new car or a holiday? Or perhaps your horizon extends to longer-term goals such as saving for a child’s education, a comfortable retirement, or building a substantial investment portfolio?

Consider these key questions:

- Timeframe: When do you need the money?

- Amount: How much do you aim to accumulate?

- Purpose: What will the money be used for?

Understanding your financial objectives will help you determine the appropriate investment strategy. For instance, short-term goals may require more conservative investments, while long-term goals can accommodate higher-risk options with potentially greater returns.

Risk Tolerance

Every investor has a unique comfort level with risk. Risk tolerance refers to your ability to withstand fluctuations in the value of your investments. It’s essential to assess your risk appetite honestly to avoid making impulsive decisions during market downturns.

High-risk investments, such as speculative property markets, can offer substantial rewards but also come with the potential for significant losses. On the other hand, low-risk investments, like government bonds, provide stability but typically offer lower returns.

Understanding your risk tolerance will help you select property types and locations that align with your comfort level.

Lifestyle Goals

Your lifestyle goals play a vital role in shaping your investment strategy. Do you desire a steady stream of passive income to supplement your lifestyle? Or are you focused on building long-term wealth and financial security?

Perhaps you’re seeking a combination of both, aiming to generate cash flow while growing your property’s value. Your lifestyle goals will influence the type of property you invest in, whether it’s a cash-flow positive rental property or a growth-oriented investment in a prime location.

By clearly defining your financial objectives, risk tolerance, and lifestyle goals, you’ll be well-equipped to make informed investment decisions. Remember, there’s no one-size-fits-all approach to property investment.

3) Capital Growth: Building Wealth Over Time

Capital growth is the cornerstone of long-term wealth creation through property investment. It refers to the increase in your property’s value over time. Imagine buying a house for $500,000 and selling it five years later for $700,000 – that’s capital growth in action.

Benefits of Capital Growth

The allure of capital growth is undeniable. It offers the potential for substantial wealth accumulation over time. As property values rise, so does your equity, providing a solid foundation for financial security. Moreover, capital growth can act as a hedge against inflation, preserving the purchasing power of your investment.

Ideal Property Types for Capital Growth

To maximise capital growth, investors often focus on property types located in high-demand areas. These include:

- Growth corridors: Regions experiencing significant population and infrastructure development.

- Suburbs with high demand: Areas with limited housing supply and strong rental markets.

- Land: While offering higher risk, land can generate substantial capital growth in the long term, especially in areas with future development plans.

It’s essential to conduct thorough market research and consider factors such as economic indicators, demographic trends, and infrastructure projects when selecting properties for capital growth.

Risks of Capital Growth

While capital growth holds the promise of significant returns, it’s essential to acknowledge the associated risks. Property values can fluctuate due to economic downturns, interest rate changes, and market sentiment. Additionally, holding a property for a long period to realise capital growth means sacrificing potential rental income.

4) Cash Flow: Generating Income Now

Cash flow is the lifeblood of many property investors. It refers to the net income generated from a rental property after deducting all expenses. In essence, it’s the money that flows into your pocket regularly.

Benefits of Cash Flow

Positive cash flow offers several advantages:

- Regular income: A consistent rental income can supplement your primary income or replace it entirely, providing financial stability.

- Debt reduction: Excess cash flow can be used to accelerate mortgage repayments, reducing interest costs and building equity faster.

- Lifestyle funding: Cash flow can fund your lifestyle expenses, whether it’s vacations, hobbies, or daily living costs.

Ideal Property Types for Cash Flow

To maximize cash flow, investors often target properties in:

- Positive cash flow suburbs: Areas where rental yields are higher than average, allowing for positive cash flow from the outset.

- Rental demand areas: Locations with a strong rental market, ensuring consistent occupancy rates and rental income.

- Multi-unit properties: Properties with multiple units, such as duplexes or apartments, can generate higher rental income and potentially offset expenses more effectively.

It’s important to conduct thorough market research and financial analysis to identify properties with strong cash flow potential.

Risks of Cash Flow

While cash flow is attractive, it’s important to be aware of potential challenges:

- Tenant turnover: Vacancies between tenants can disrupt cash flow. Effective tenant management and maintenance can help mitigate this risk.

- Property management challenges: Managing rental properties can be time-consuming and stressful. Consider hiring a professional property manager to handle day-to-day operations.

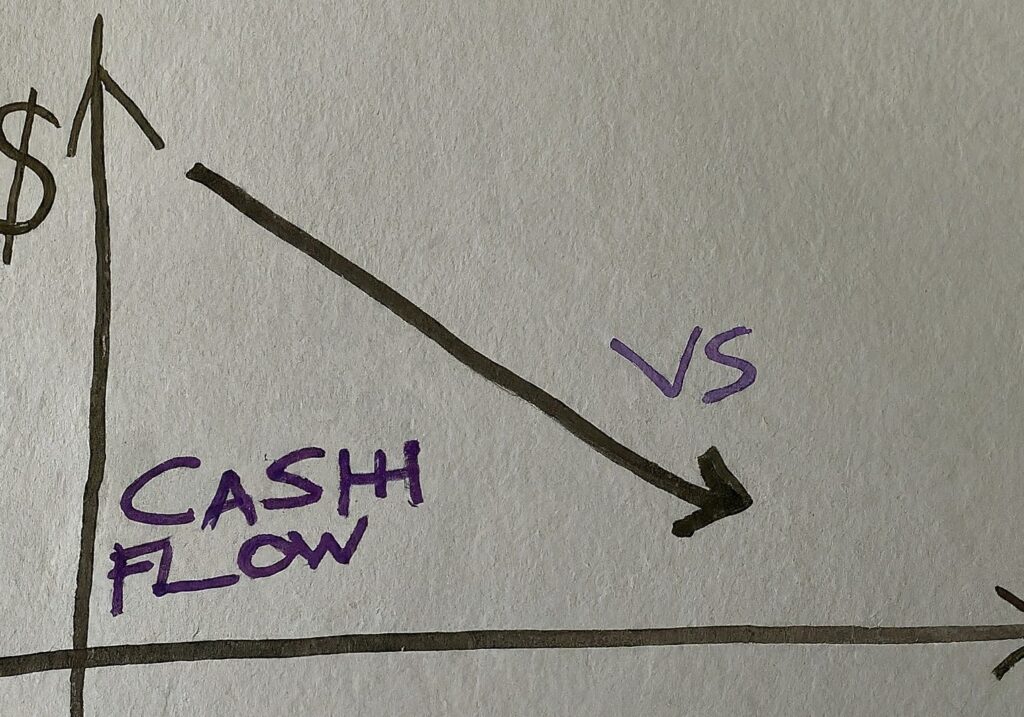

5) Capital Growth vs. Cash Flow: Which is Right for You?

The age-old question for property investors is whether to prioritize capital growth or cash flow. The ideal strategy often depends on your circumstances, financial goals, and risk tolerance.

Investor Profiles

Different investor types have varying preferences for capital growth and cash flow:

- Short-term investors: Often seek properties with strong rental yields to generate immediate cash flow, potentially refinancing or selling the property within a few years.

- Long-term investors: Typically prioritize capital growth, focusing on property appreciation over time. They may be willing to sacrifice immediate cash flow for the potential of substantial wealth accumulation.

- Retirees: Often require a steady income stream, making cash flow properties an attractive option. However, some retirees may also consider capital growth to supplement their retirement savings.

- Self-managed super funds (SMSFs): Can benefit from both capital growth and cash flow. Capital growth can increase the fund’s value, while cash flow can provide income for retirement.

Balancing Capital Growth and Cash Flow

While many investors focus solely on either capital growth or cash flow, it’s often possible to achieve a balance between the two. For example, purchasing a property in a growth corridor with strong rental demand can generate cash flow while also benefiting from potential capital appreciation.

Diversifying your investment portfolio across different property types can also help you achieve a balance. For instance, owning a cash-flow-positive rental property in a stable suburb and a growth-oriented investment in a developing area can provide a mix of income and long-term wealth potential.

The Role of Beyond Realty

Choosing the right investment strategy can be complex. That’s where Beyond Realty comes in. Our team of experienced property experts can help you assess your financial goals, risk tolerance, and market conditions to determine the best investment approach for you.

We offer comprehensive property search and selection services, leveraging our in-depth market knowledge to identify properties that align with your investment objectives. Whether you’re seeking capital growth, cash flow, or a combination of both, Beyond Realty is committed to helping you achieve your property investment dreams.

6) How to Choose the Right Property

Selecting the right property is a critical step in achieving your investment goals. It requires careful consideration of several factors.

Location Analysis: The Heart of Property Investment

The adage “location, location, location” holds true in property investment. A well-chosen location can significantly impact both capital growth and cash flow.

- Market research: Understanding local demographics, economic trends, infrastructure development, and future growth plans is crucial.

- Rental demand: Assessing the demand for rental properties in the area can help determine potential cash flow.

- Capital growth potential: Identifying areas with strong historical price appreciation and future growth drivers can maximize capital gains.

Property Type Assessment: Aligning with Your Goals

The type of property you choose should complement your investment objectives.

- Capital growth: Properties in high-demand areas, such as inner-city apartments or waterfront homes, often offer strong capital growth potential.

- Cash flow: Investment properties in areas with high rental yields, like suburban houses or units, can generate consistent rental income.

- Diversification: Consider a mix of property types to spread risk and optimize returns.

Financial Analysis: The Numbers Don’t Lie

A thorough financial analysis is essential to make informed investment decisions.

- Rental yield: Calculate the expected rental income as a percentage of the property’s purchase price to assess cash flow potential.

- Capital growth potential: Analyze historical property price trends in the area to estimate future capital growth.

- Expenses: Consider ongoing costs such as property taxes, insurance, maintenance, and potential vacancy periods.

- Cash flow projections: Create a detailed budget to determine the property’s profitability and cash flow.

The Value of Expert Advice: Partnering with Beyond Realty

Navigating the complex property market can be overwhelming. That’s where Beyond Realty comes in. Our team of experienced property experts can provide invaluable guidance throughout the property selection process.

- Market insights: Benefit from our in-depth knowledge of local market conditions and trends.

- Property selection: Let us help you identify properties that align with your investment goals and budget.

- Negotiation: Our expertise can help you secure the best possible deal on your property purchase.

- Ongoing support: We’ll be there to assist you throughout the investment journey.

By combining thorough research, careful analysis, and expert guidance, you can increase your chances of making successful property investments.

8) Conclusion

Understanding the nuances between capital growth and cash flow is essential for making informed property investment decisions. Capital growth offers the potential for long-term wealth accumulation through property appreciation, while cash flow provides a steady income stream.

The optimal investment strategy depends on your individual financial goals, risk tolerance, and lifestyle preferences. By carefully considering your objectives and conducting thorough market research, you can select properties that align with your vision.

Beyond Realty is your trusted partner in achieving property investment success. Our team of experts is dedicated to helping you navigate the complex property market and make informed decisions. We offer personalized guidance, property selection services, and ongoing support to ensure your investment journey is smooth and rewarding.

Ready to take the next step? Schedule a free consultation with our property investment specialists today. Let us help you unlock the full potential of your property investment goals. Contact Beyond Realty now and embark on a path to financial freedom.